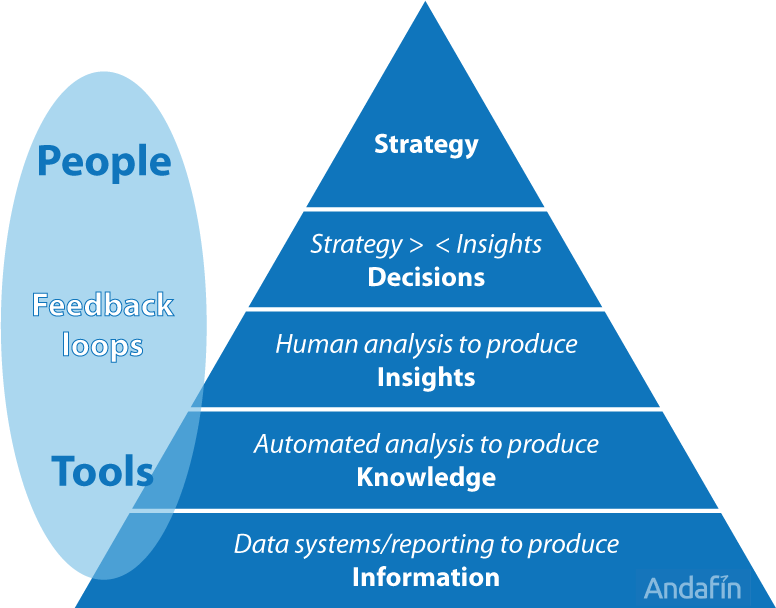

Andafin helps you build your financial institution’s capabilities and use the power of data to reach the next billion customers. Step-by-step, we utilize a broad range of expertise to help our clients succeed: building a strong data foundation, improving operational decision-making, uncovering strategic insights, and helping to drive growth.

Building the foundation: Data services

Data foundations: Our data team works with your financial institution to organize and export data from your systems to Andafin’s financial services data engine. Along the way, we provide feedback on data quality, and can assist in improving data capture and structure to ensure the best possible “return on data.”

This stage often sheds light on an institution’s potential need and preparedness for a change of its core banking system, especially as the customer base grows. We can assist with such a change from a data quality perspective, even as we utilize data from disparate legacy systems to produce high-quality analysis. Working with your existing systems enables us to provide sound advice on the change of core. We are also here to help implement changes, as our analytics continue to run throughout the system transition.

Data services

—

Operational services

—

Strategic services

—

Investment support services

Running the trains on time: Operational services

With the foundation of data collection and analysis tools in place, we offer a variety of services to help senior management and field staff manage day-to-day operations.

Operational analytics subscriptions/dashboards may include:

- Clear, concise view of operations for each level of management

- Operational alerts to focus managers’ attention on performance outliers

- Branch-level profitability ratios

- KPI tracking and loan officer performance (often an input to incentive plans)

- Policy compliance monitoring

Credit decision analytics offerings include:

- Cross-reference portfolio performance with credit bureau data

- Credit scoring model upgrade

- Advanced credit model

Charting the course: Strategic services

Even the best data analysis is only as good as the decisions made, and actions taken, by the leaders in charge. Our consultants work with your senior leadership team to see the possibilities provided by new insights and to make crucial decisions that move business forward.

Data-backed consulting services

Based on our data insights, we can provide much of our advice remotely. This saves costs and allows us to use valuable on-site time for vital in-person discussions with your staff and customers.

- Strategy development: Based on our data analysis and discussions with field staff and customers, we work with senior management to build or refine your company’s strategic plan.

- Optimization: We advise on how to optimize both cost of capital and portfolio distribution across branches and by products, as well as identifying areas where processes may be unnecessary, inefficient, or absent.

- Product development, client targeting and market entry: Growing financial institutions benefit from our services leveraging data to make decisions about product and client targeting as well as new opportunities.

- The women’s market: Women remain underserved in many countries, and financial institutions that understand their value and needs will have an advantage. At the same time, many financial institutions struggle to properly capture gender data, especially from SME customers. Our extensive work with gender data enables us to assist financial institutions to better capture data and act upon the potential of women customers.

- Incentive plans and loyalty programs: We can develop a plan to align interests across the entire staff or customer base, and project the cost and impact of a new plan.

- Business restructuring and cost control: For established clients with financial data of sufficient quality, we cross-reference portfolio and cost data and find ways to streamline operations.

Strategic analytics subscriptions/dashboards

Andafin’s strategic reporting services keep senior management up-to-date on the latest portfolio developments, at an appropriate level of detail and focus. Along with helping the management understand customer segment and product performance in risk and revenue terms, we can track segment profitability and customer lifetime value to better inform strategic decisions.

Catalyzing growth: Investment support services

Growing financial institutions require increasing capital. Our services can help financial institutions to attract and retain debt and equity financing, and give investors deeper insights into their investments:

- Portfolio valuation uses our transaction-level analysis and profitability metrics to calculate the fair value and forecasted valuation trend of a loan portfolio or tranche of securitized loans.

- Portfolio monitoring keeps investors informed of ongoing portfolio quality, and flags opportunities to make improvements.

- Covenant monitoring applies specific rules found in securitization covenants, and reports when compliance is maintained or there is a danger of breach of covenant.