Emerging-market financial institutions have a golden opportunity to establish data-driven systems that will make them nimble competitors for the business of the global middle class: the “next billion” customers. These opportunities arise from a tidal wave of data — and financial institutions that know how to capture and use this data will have a clear advantage.

Andafin is here to help you unleash the power of data. Our approach enables us to rapidly acquire a deep understanding of your business, from the transaction level up. To do this, we use your bank’s data to generate insights for today and prepare you for the future.

Financial institutions capture an increasingly broad range of data, but much of it remains “dark,” an untapped resource that could inform better decision-making. Core banking systems provide reports that serve certain operational needs, but deeper insights that could enhance both operations and strategy remain hidden. Andafin illuminates your “dark” data to bring insights into the open. We not only provide more descriptive reporting, but also explain the reasons behind the observed results.

Powerful technology

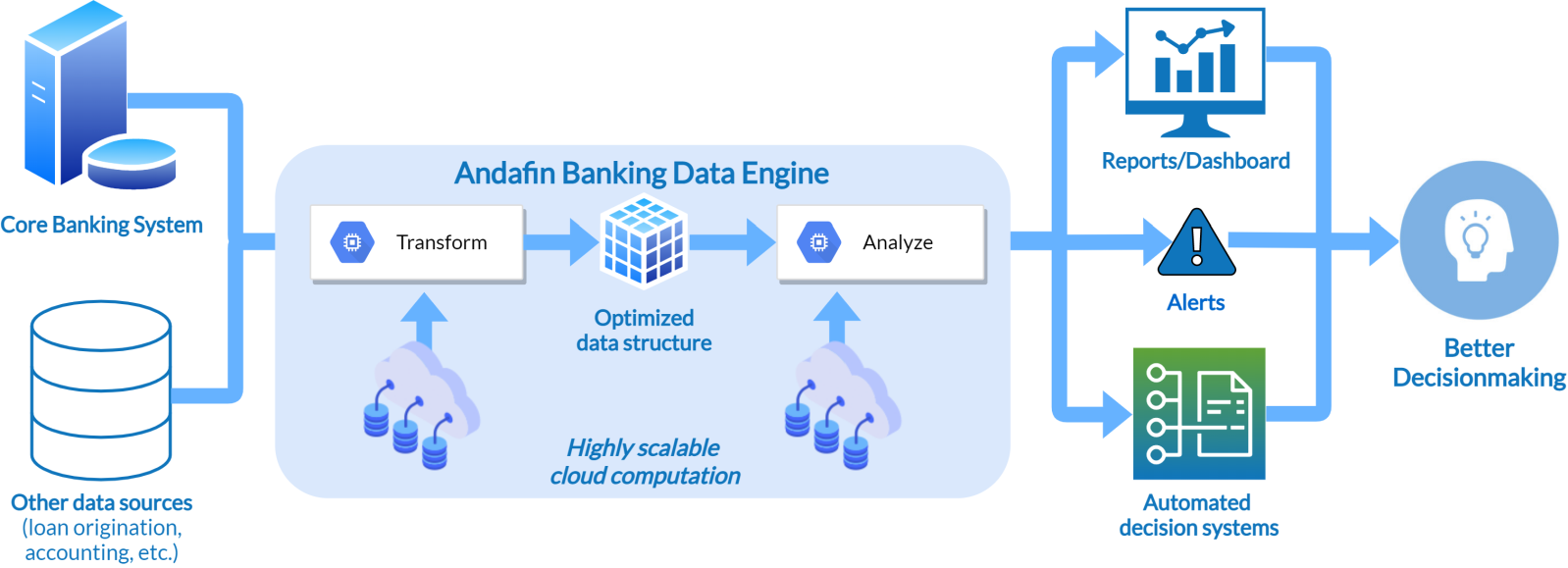

Andafin’s banking data engine uses customer-level loan and deposit transaction data from your core banking system, combined with data from other sources such as field tablet or loan origination systems, to produce insights on your products and customers.

Refined over the course of analyzing data from millions of customers, our engine combines and structures financial services data. It analyzes this data using Andafin’s proprietary software, based on the powerful R statistical programming language. Thanks to the power of secure, scalable cloud computing, our banking data engine handles data from any size financial institution to produce weekly or daily insights with intuitive visualizations that help managers focus on key trends in the operations and customer base.

Deep expertise

We are here to solve your problems. While we use powerful technology, the power is ultimately in the hands of the user. And we bring you the best experts in statistical programming, cloud computing, data management, customer insights and financial services. Our consultants bring decades of experience working in over 30 countries to bear on the challenges you face.

We have worked with large and small financial institutions (whether standalone or part of a network), with both commercial and social motivations, in regulated and unregulated environments. Some of our clients have a gender focus, while others are just starting to explore the potential of the women’s market. We have experienced the competitive and regulatory pressures that can suddenly change the dynamics of a financial services business, and we help businesses take a proactive approach to managing these challenges.